I had an email in my inbox this morning from RealtyTrac which had a headline: Top Celebrity Foreclosures. Sad how the public thrives on the misery of others isn’t it? Here’s a blurb from it about recent VIP’s who’s homes slide into delinquency, despite their fame and fortune. Some of them were able to negotiate with the banks who held their mortgages and save their homes but some, like Jose Canseco, apparently did what is called “strategic default” which is where you purposely let the home foreclose because you feel it is no longer a wise investment. I was a bit shocked that Mr. Canseco didn’t have a better legal team to advise him that this is never a good idea.

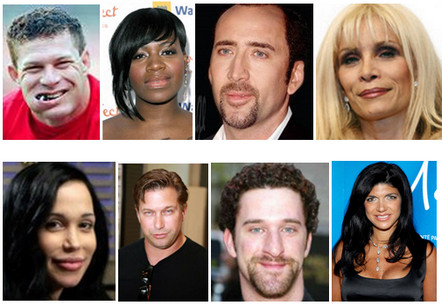

Top Celebrity Foreclosures

Nicolas Cage

Nicolas Cage lost several real estate investments to banks. He lost both his French Quarter and Garden District homes in a New Orleans sheriff’s sale. Cage also lost his Las Vegas home to the bank.

Victoria Gotti

Victoria Gotti, the daughter of the late Gambino crime boss John “The Teflon Don” Gotti, ran into foreclosure trouble with JP Morgan Chase on her lavish Old Westbury, Long Island home, on which she owed $650,000. The Mafia princess made the bank an offer they couldn’t refuse and saved the monster mansion from the auction block.

Evander Holyfield

Boxing champion Evander Holyfield beat back a foreclosure on his Fayette County, Georgia mansion. The “Real Deal” managed to save the $10 million home.

Jose Canseco

Former baseball slugger Jose Canseco walked away from his $2.5 million home in Encino, Calif. “It didn’t make financial sense for me to keep paying a mortgage on a home that was basically owned by someone else,” Canseco told TV show “Inside Edition.”

Veronica Hearst

Faced with millions in debt, New York socialite Veronica Hearst lost her $45 million

beachfront Florida residence to a foreclosure auction. The palatial 52-bedroom second home was sold at auction for $23 million to Ridgefield, Conn.-based New Stream Secured Capital.

Michael Vick

After serving nearly two years in prison for running an illegal dog fighting ring, NFL

quarterback Michael Vick lost his $3 million Duluth, Ga., home to foreclosure.

Aretha Franklin

Singer Aretha Franklin – the “Queen of Soul” – lost her Bloomfield Hills, Mich., home to

foreclosure after falling behind on property taxes. She owed a total of $19,193 in back taxes on the $700,000 home, according to the Detroit Free Press.

Jeana Keough

Jeana Keough, the former star of “The Real Housewives of Orange County,” ran into

foreclosure trouble when her Coto de Caza, Calif. home was slapped with a notice of default. She quit the show to focus on her real estate career.

The reason I thought to share this is because its apparent to me that it doesn’t matter how much money you have – everyone is facing tough times right now. And even some celebrities have gotten bad foreclosure advice. It’s always best to speak to a good foreclosure attorney (or a couple of them) if you may be facing foreclosure or are behind on payments. Most attorneys we’ve spoken to say that its always the last resort to let your home be foreclosed on, and that a short sale is usually a better option because there is less chance that the bank will pursue for the deficiency down the road.

Although we do not know the particulars of Canseco’s situation and we are not attorneys, it would seem that since he’s a wealthy athlete , the bank may be very likely to pursue him down the road for the deficiency balance between what he owed on his mortgage and what it ultimately sold for at foreclosure auction. Just because someone lets a home be foreclosed upon does not mean the bank says “oh well, I guess that’s that, we can’t come after you now for what you owed us”. He made a commitment to a mortgage and just because the home is not worth now what it once was does not mean he is released from his obligation, especially when he has the means to pay and is not facing a hardship. It’s not like a bankruptcy and does not discharge you from the debt that is owed. Even if you have the means to pay, offering the bank a short sale is often a good faith way to show the bank that you are trying to work out a compromise and may help them not to pursue for deficiency in the future.

We have 5 years experience listing and getting our short sales closed successfully for our clients. If you think you may be facing foreclosure, we can recommend a short sale/foreclosure attorney that you can speak to and we’d be happy to assist you in short selling your home at no expense to you. Contact us today for a free consultation. Do not become another foreclosure statistic.

Images courtesy RealtyTrac and Zillow.

Leave a Reply