News articles have hit the web today from The Wall Street Journal and other major publications with these words:

“The housing market has turned—at last.”

and…

“It’s official: The housing market has reached bottom, at least according to 44 forecasters surveyed by The Wall Street Journal. Only three economists surveyed said they didn’t think the market had reached bottom yet. ”

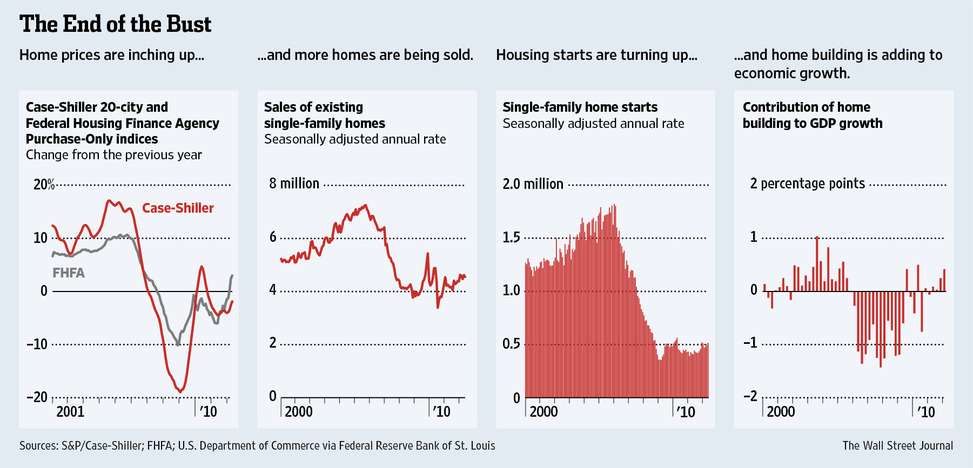

A few key indicators, the experts say are that builders have begun work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. In the first quarter, it accounted for 0.4 percentage points of the meager 1.9% growth rate.

Also nearly 10% more existing homes were sold in May than in the same month a year earlier, many purchased by investors who plan to rent them for now and sell them later, an important sign of an inflection point. In something of a surprise, the inventory of existing homes for sale has fallen close to the normal level of six months’ worth despite all the foreclosed homes that lenders own. The fraction of homes that are vacant is at its lowest level since 2006.

What do you think – is the market on its way to recovery? Take the poll below.

[poll id=”2″]

Leave a Reply