It’s a crazy time in the world of real estate in Summer 2020, as we are smack dab in the middle of a pandemic called Covid-19. There is a lot of confusion and chatter among financial and real estate professionals about what the future holds. We are seeing articles that mortgage defaults are up due to significant job losses, and many are waiting to see if the sky is going to fall again like in 2008. Here are my thoughts on that, and the latest data from our local Tampa Bay real estate market.

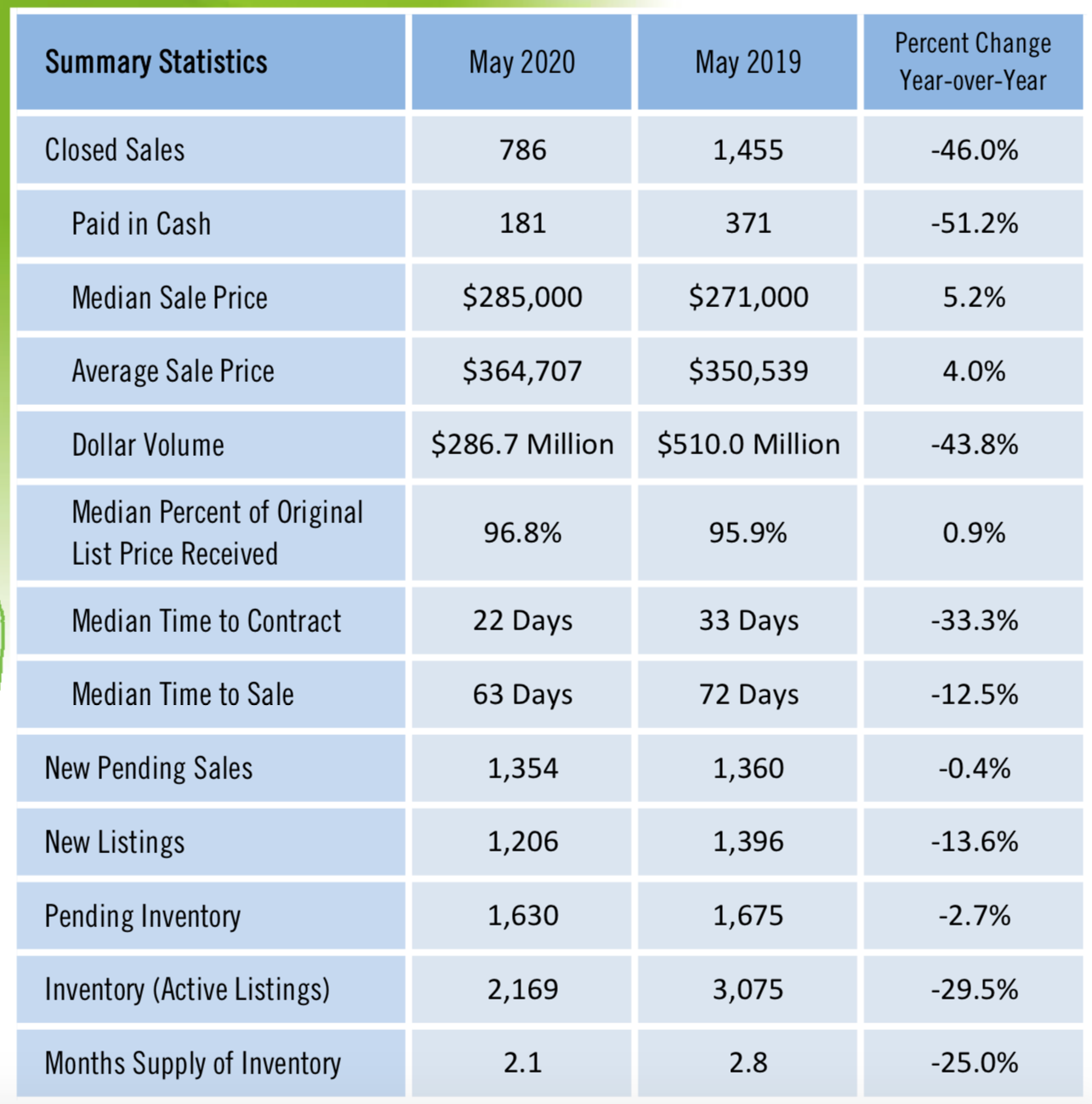

First, let’s look at the numbers this month as compared to this time last year. We’re are down to 2.1 months of inventory. What that means in English, is that if all the homes on the market today sold, and no new ones were listed, we’d run out of homes to sell in 2.1 months. This is the lowest level of inventory I have seen since I got my real estate license in 2006 – 14 year low. 6 months is considered a balanced market, and under is a seller’s market, over is a buyer’s market. So, yes, we are in a seller’s market. Still, buyers are buying homes like crazy, even amid this pandemic! Why? Well, several reasons but the biggest I can think of are 1) People are staying home more and really want a home that fits their needs and 2) Interest rates are at an all time low as well. I saw 2.74% on a 30 year fixed mortgage a few days ago. That is CRAZY low.

The chart above may be confusing to some who, like our local paper say “sales have plummeted” because are are down 46% since last year – but this paints a bit of an incorrect picture. That makes it sound like no one’s buying, and I am here to tell you that couldn’t be farther from the truth. It is obviously because of the lack of supply. There are so few homes for sale we really don’t have enough to go around. My most recent listing got 6 offers in one day and went $14,000 over asking price.

What happens when supply is low but demand is still high? Prices go up – as evidenced above. The median sale price is up 5.2% over last year.

So about these people who’ve lost their jobs and stopped paying their mortgages? Is this going to cause foreclosures to flood the market? In short, I don’t think so. Here’s why:

1) A 2008 type crash happens only once in a lifetime. You won’t see it again. Sorry if you missed out on those sweet foreclosure deals.

2) Too many people have a lot of equity in their homes, we learned from 2008 and not a lot of people have pulled all their equity out of their homes so it’s unlikely we’ll see as many short sales or foreclosures as before.

3) People would rather sell their home than face a foreclosure, so if homeownership becomes unaffordable, they will list their home for sale.

4) Inventory (number of homes available for sale) is extremely low and if distressed owners list, properties will sell at market value or maybe even above because of this shortage of homes, not at a huge discount.

In short, if you are waiting for prices to drop in order to buy, you are in for a very long wait. I think we may see a little more inventory come on the market in 6-12 months or so when people who’ve stopped paying their mortgages have to face either selling their home to satisfy the bank, or deal with a foreclosure on their record. Like I said, my guess is most would rather sell. A little more inventory should not make prices go down – it’s a seller’s market until such point that we have 6 months of inventory which I think will take a long time to hit.

So what if you’re a buyer? It’s still a good time to buy, if you can find a home you love at 2.74%, especially if you plan to stay in it for more than a few years.

If you’re a seller – what the heck are you waiting for? Sell now, before more inventory hits the market and you have more competition. Call me!

Leave a Reply