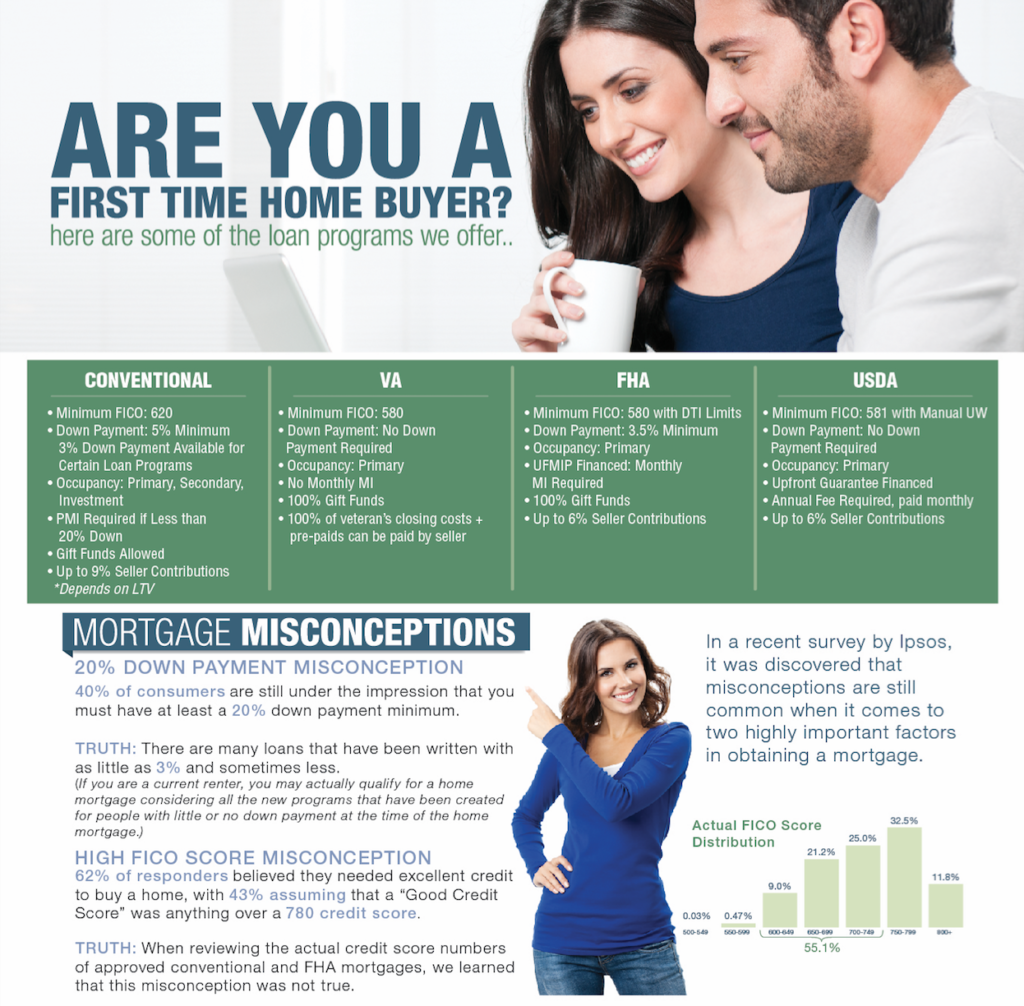

Many would-be first time homebuyers mistakenly think they need 20% down to buy a home. This couldn’t be further from the truth. There are 100% loan products like the VA loan for military members, and there are even conventional loans as low as 3% down.

What does that mean? Let’s break it down.

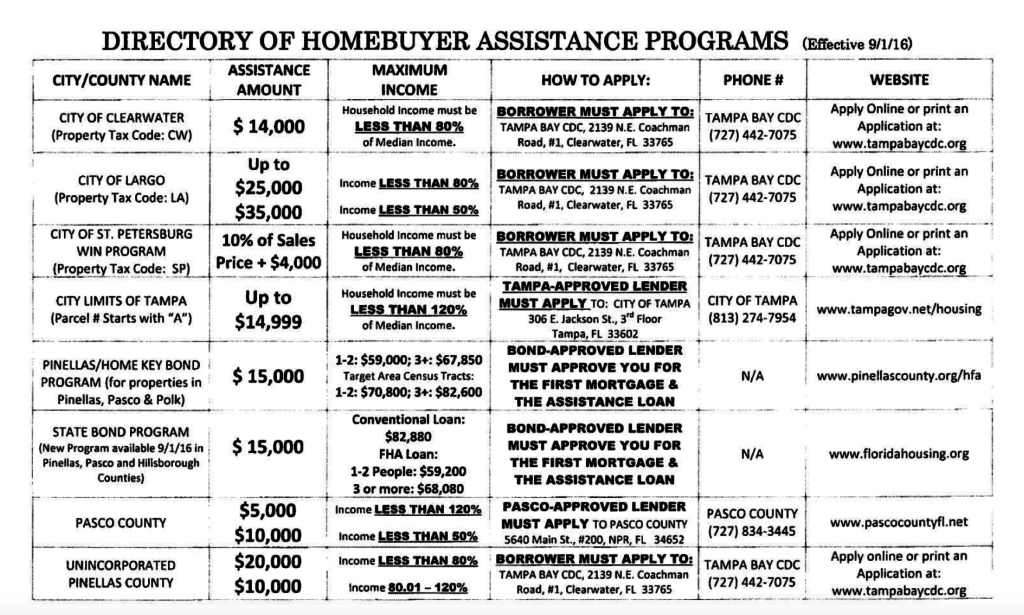

If you are buying a $200,000 home, 3% down would be $6,000. Now if you were buying in Clearwater and qualified for the City of Clearwater Down Payment Assistance program – you could get up to $14,000 towards that down payment and have to bring zero out of pocket.

Let’s say you don’t qualify for one of the down payment assistance programs because you make too much salary. For many loan types, you can use “gift money” as your down payment. What does that mean? Let’s say Grandma is willing to give you $6,000 out of your future inheritance – there’s your down payment.

In some cases you can have as low as a 580 credit score to qualify to buy a home. Depending on your income, you may also qualify for homebuyer assistance programs like the one below.

Credit score below 580? Don’t dismiss the idea of buying a home yet. Our in-house lender offers a program where they can review your credit and help repair it quickly to get your score up to the necessary number.

In one case, one of our buyer clients had too many credit cards with revolving balances. Our lender was able to look at her credit, which was just barely below a 580, and said “Pay off exactly $53 on your Victoria’s Secret card and your score will jump 20 points.” “What? It’s that easy?” she said. In some cases, yes, if your score is just below the minimum, it doesn’t always take a ton of money to raise your score. Seek the advice of our lender – because you also don’t want to put ALL your available cash towards your credit cards or you’ll throw off your debt-to-income ratios, which is something lenders look closely at. It’s a delicate balance and we are here to help you navigate it! If your score is well below a 580, these programs can still help clean up your credit and get your score on the rise so you can buy a home in the not-so-distant future.

There are many reasons why you might want to stop renting and start owning.

- No landlord

- No pet restrictions

- Mortgage payment lower than rent payment

- Federal tax deductions

- Get the home you’ve always wanted

- Lock in your payment and escape rising rental prices

You may be thinking – okay – how do I find out if I qualify for any of these programs? Simply click the link below to get started. We will reach out to you with a few questions about your individual circumstances and then we’ll have our in house lender chat with you to find out what you qualify for and what your approximate monthly mortgage payments would be. Homeownership does not have to be a distant dream – it could become a current reality.

Start today – click here to Stop Renting and Start Owning!

Leave a Reply