Tired of getting outbid by other buyers in a hot real estate market?

A strategy that we’ve been using for some time when appropriate is called an Escalation Clause. It is important to note that the escalation clause may not be legal in every state, but it is here in Florida. I was recently quoted on this very topic in 5 Tips for Buying in Hot Real Estate Markets.

How does an escalation clause work?

Let’s take this example: Sellers list their house for $350,000. Their real estate agent has done her homework and believes it is a fair price. There is an open house on Sunday, and 15 people show up. Two couples express an interest, and each submit an offer. In the Tampa Bay area, it is customary for a buyer to submit an offer; the seller has three options: accept the offer, reject it or counter the offer with different terms.

Couple No. 1, represented by Jamason Realty Group in this scenario, fill out an “Escalation Clause” form. The offer and escalation clause form addendum state that they are offering $350,000, with a contingency for obtaining an 80% mortgage, but adds in the escalation form that they are prepared to increase their offer by $1,000 over any other offer, but in no event shall the offer exceed $360,000.

The seller then gets an offer of $351,000 from the Couple No 2, represented by Fictitious Realty, with no escalation clause.

Who’s offer should they accept?

Couple No. 1’s offer of course – because in this scenario, the seller will receive $352,000 for their home because the Escalation Clause states they will go to $1,000 over any other offer.

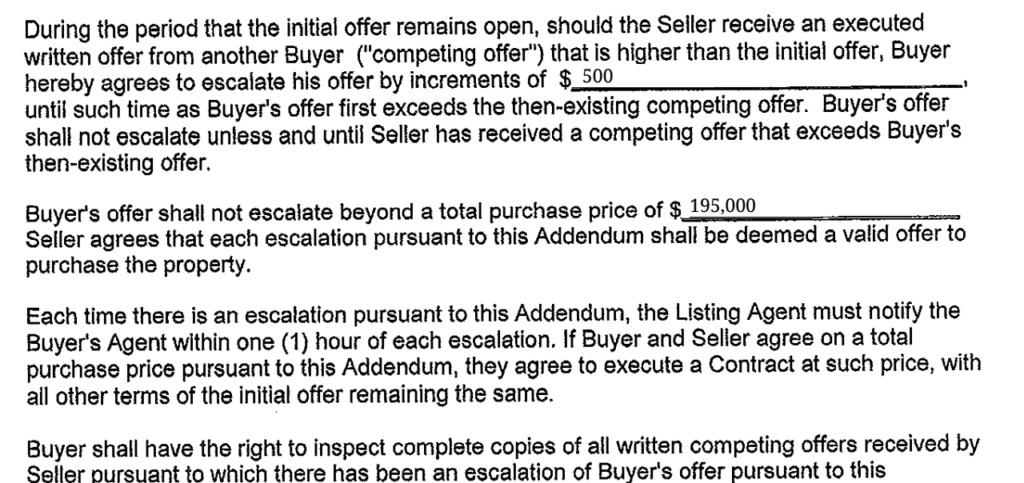

While escalation clauses vary significantly, the general escalation addendum has a few basic components:

- What is the original offer of purchase price?

- How much will that price be escalated above any other competitive bid?

- What is the maximum amount that the purchase price can reach in case of multiple offers?

New Pinellas County Homes for Sale Under $400,000

When should an escalation clause be used?

Not in every offer scenario should a buyer’s agent use an escalation clause, because when you do, you are laying all your cards on the table about how much you are really willing to pay. Let’s say a property has been listed for 36 days, and the buyer’s agent reaches out to the listing agent before preparing the offer and the listing agent says there are no other offers on the table or expected, then in this case an escalation clause is probably not necessary. It would be more appropriate if the property had only been on the market a day or two and the listing agent said “I’m expecting 4 offers, you’d better hurry.”

Will the seller accept an escalation clause?

It’s rare in my experience, but some home sellers simply state that they will not accept an offer with an escalation clause. They would prefer that every buyer submits exactly what they’re willing to pay. However again this is rare in my experience and most sellers want to get the most they can for a home and if an escalation clause means they can squeeze out a few thousand more in a multiple offer situation, they are usually all for it.

Ideal situations for using an Escalation Clause

Escalation clauses should ONLY be used when the buyer or buyer’s agent is confident that there will be multiple offers, or when the buyer expects to pay over the asking price. If a buyer submits an offer with an escalation clause, they’re laying all their cards on the table: now the seller knows immediately how far the buyer will go to buy the home.

Is the property a short sale or foreclosure, or investor owned property? Has the listing agent clearly stated a 7-day review or multiple rounds of offers?

In hot markets, there can be a wide variety of offer-review processes. Some state will state that the property is going on the market Monday and all offers will be reviewed Friday at 5pm. The seller and their Realtor will make a final decision that day. This situation can be perfect for the escalation clause, when a buyer knows its a one shot opportunity.

What Could Go Wrong Using an Escalation Clause

Again, when you use an escalation clause – you are laying all your cards on the table. In the scenario above, if the Seller received an offer of $350,000 with an escalation to $360,000 – they could easily turn around and counter back at $360,000 – knowing the buyer will probably pay it rather than accepting the offer the way it was written.

Also, keep in mind, if you are getting a mortgage you may wish to include (or not include, depending on how attractive you want your offer to be to the seller) an appraisal contingency any time you submit an offer that may be over the asking price. If the asking price of the home is $350,000 and your escalation goes up to $375,000 and you wind up paying $365,000 – that’s great. But what if it only appraises for $355,000? As long as you are OK with paying that $10,000 difference in cash versus financing it – you are fine – but otherwise an appraisal contingency can help protect you in this scenario.

The Escalation Clause can be a complicated legal addendum to the standard real estate contract and not something to be used by the inexperienced Realtor. If you are tired of getting outbid in this hot Tampa Bay real estate market, please allow us to represent you on your next home purchase.

Contact Us Now

Leave a Reply