Often times at Jamason & Associates, we hear from buyers “I only want to see short sales and foreclosure homes”. We understand – hey – everyone wants a deal and to save money right? Of course, and we don’t blame you! But before you decide as a buyer to tell your Realtor this, consider a few things before making your decision and filtering all “non” distress sales out of your search.

Did you know that according to research only 20% to 30% of short sales ever actually get to the closing table? The number is higher for foreclosure properties but not by a ton! Did you also know that many short sales and foreclosures these days are priced at market value or slightly below, and so regular sellers (as well as new construction builders) are having to compete, and pricing their homes at equally affordable prices (with fewer hassles?)

A few more facts to consider when choosing your next home.

Foreclosure Homes:

- Can be a great deal and are generally priced to sell – fast. You may be competing with investors when offers are being submitted.

- Can generally close in 30 days or less.

- You will usually know if your offer is accepted by the bank within 1 to 5 days.

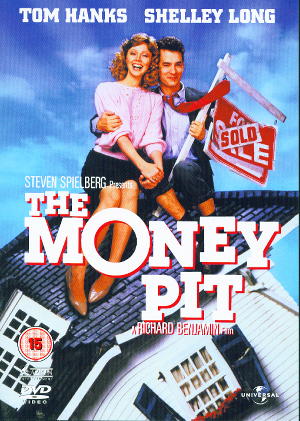

- May have deferred maintenance issues and need significant repairs (remember the movie “The Money Pit” from the 80’s with Tom Hanks and Shelley Long?!)

Short Sales:

- Generally cannot close in 30 days unless they are already deemed “bank approved short sales”. Even then, sometimes there are delays.

- You must wait 1 to 9 months (sometimes longer – I had one that took a year!) to hear from the Seller’s lender as to whether your offer has been approved or not. You must learn the art of patience if you are going to wait on a short sale to be approved. It is not, by any means, a fast process.

- The bank has not determined the sales price, the listing Realtor has, and it may not be accepted by the bank until Seller’s hardship is determined and a Broker Price Opinion (like an informal appraisal) has been obtained by the bank.

- May have deferred maintenance issues and need significant repairs (again – the Money Pit!)

Regular Listings:

- Are competing with short sales and foreclosures and may be priced equally low (or your Realtor can use comparable sales to support a competitive offer!)

- Can generally close quickly if Seller is able.

- May involve fewer appraisal hassles and delays if Seller has prepared on their end.

- Seller will disclose facts that materially affect the value of the property (not the case with foreclosures). May have less deferred maintenance.

New Construction:

- If inventory, can close immediately.

- The builder may pay your closing costs or buy down your interest rate, and is competing with the foreclosures too, so prices are good!

- Generally has a 10 year structural warranty, and new everything – no deferred maintenance or repairs!

So before you decide that foreclosures and short sales are the steal of the century – take a look at all your options and consult your Realtor about what’s best for you and your family, and the time frame for moving into your next home.

Both have their advantages and disadvantages. Short sales you are rolling the dice that the 3rd party lender is going to agree to sell at the offer price. With Bank Owned properties you already have a list price that the bank has set. Not necessiarly in stone, but at least a baseline to work from. Short sales can take months to close. Bank owned can close in 30 days. You could end up paying more than the listing price on both types of properties. If you have lots of patience short sales may be the way to go. If not, you may want to focus on bank owned properties.

Both have their advantages. Short Sales are a great buy if you have the patience to wait a few months until the bank approves the deal. Bank Owned are also great deals but you may get into a bidding war with other buyers. Bank Owned can close in less than 30 days. The only disadvantage to both types of sales is that you could end up paying more than the original offer price. No matter how you look at it you are buying homes well under current market prices. There are a lot of great deals and there is no better time to buy a home.

We agree Ed!

I agree, Short Sales are tough when you’re the buyer. It takes longer to close and the outcome is less certain. But, because bank-owned (REO) homes and homes with positive equity listed at or near market value are snapped up so quickly, the only alternative is to buy a short sale. Well, there is another alternative: pay way, way too much for a home on which the owner is upside down.