Fannie Mae Shortens Waiting Period After a Derogatory Event

There’s great news for buyers looking to purchase a home after going through bankruptcy, short sale or pre-foreclosure! Under the new Fannie Mae guidelines, a borrower no longer has to wait a minimum of 4 years before trying to get a mortgage. Instead, a borrower only has to wait HALF that time… just two years!

It’s important to note before we get too far into this that the new Fannie Mae rules come with a strict set of guidelines that MUST be adhered to.

The new guidelines state that the two year waiting period is permissible IF there are documented extenuating circumstances. So, what does Fannie Mae consider an extenuating circumstance? Here is an excerpt from their website: You can also read it for yourself here.

“Extenuating circumstances are nonrecurring events that are beyond the borrower’s control that result in a sudden, significant, and prolonged reduction in income or a catastrophic increase in financial obligations.

If a borrower claims that derogatory information is the result of extenuating circumstances, the lender must substantiate the borrower’s claim. Examples of documentation that can be used to support extenuating circumstances include

- documents that confirm the event

- such as a copy of a divorce decree, medical reports or bills, notice of job layoff, job severance papers, etc.; and

- documents that illustrate factors that contributed to the borrower’s inability to resolve the problems that resulted from the event

- such as a copy of insurance papers or claim settlements, property listing agreements, lease agreements, tax returns (covering the periods prior to, during, and after a loss of employment), etc.

The lender must obtain a written explanation from the borrower explaining the relevance of the documentation. The written explanation must support the claims of extenuating circumstances, confirm the nature of the event that led to the bankruptcy or foreclosure-related action, and illustrate that the borrower had no reasonable options other than to default on his or her financial obligations. The written explanation may be in the form of a letter from the borrower, an email from the borrower, or some other form of written documentation provided by the borrower.”

Let’s Break it Down

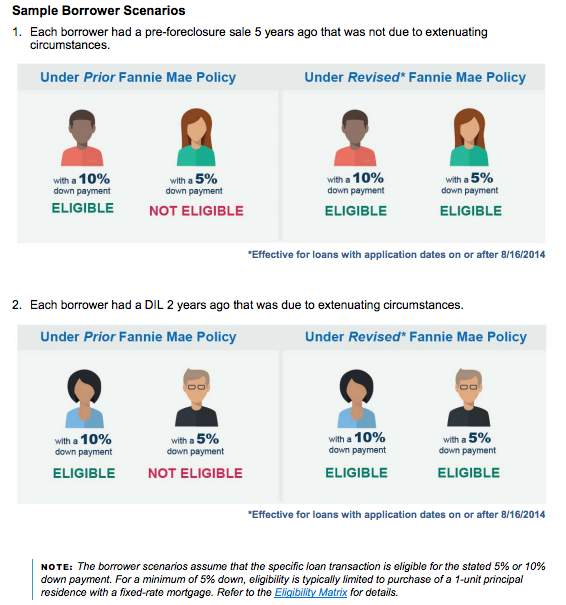

Let’s face it… all of this is CONFUSING!!! Let’s look at the chart below from Fannie Mae to help us understand the new policy.

There are two scenarios. The first assumes that there were no extenuating circumstances. After 5 years the new policy allows a borrower to apply for a loan with as little as a 5% down payment after a 5 year waiting period. Prior to these guidelines that borrower would not have been eligible.

The second scenario is an illustration of what we’ve been talking about. In this scenario each buyer had a short sale, pre-foreclosure or bankruptcy two years ago that WAS DUE TO EXTENUATING CIRCUMSTANCES. With the proper documentation a home could be purchased by a borrower after just 2 years with as little as a 5% downpayment.

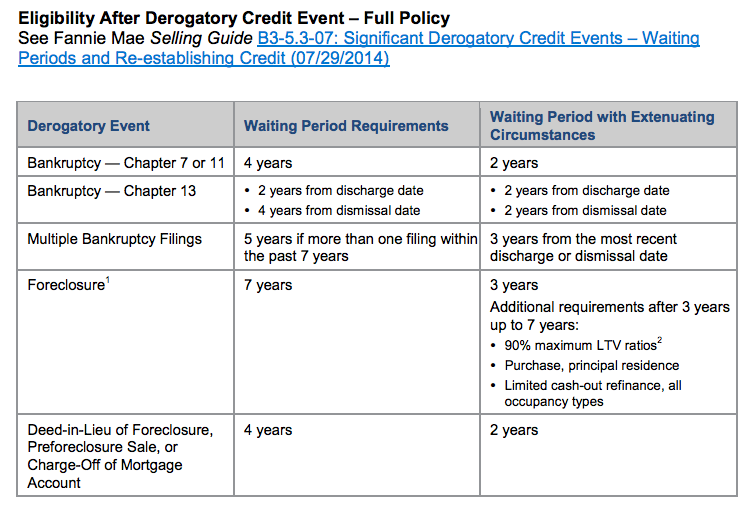

Here is a diagram of the full policy as it applies to bankruptcy, foreclosure, and short sales. The change we have been discussing is at the very bottom of the chart.

Finding the Right Plan

Another program that offers a shorter waiting period for borrowers who want to purchase a home after bankruptcy, short sale, or foreclosure is called the FHA Back to Work program.

Dan Green, a mortgage market expert, explains the details of the program in this article. He writes that in order to qualify for the FHA Back to Work program a borrower must meet four criteria:

1.) Meet standard FHA loan requirements

2.) Document prior financial hardship

3.) Re-establish a responsible credit history

4.) Attend a homeowner counseling program

Green provides this chart for borrowers to see what the former Fannie Mae guidelines were compared to the new guidelines and then it compares the new guidelines to the FHA program.

| Prior Fannie Mae Minimum | New Fannie Mae Minimum | Current FHA Minimum | |

| Short Sale | 4 Years | 2 Years | 1 Year |

| Bankruptcy | 4 Years | 2 Years | 1 Year |

| Pre-Foreclosure | 4 Years | 2 Years | 1 Year |

Explore Your Options… Make an Informed Decision

Mortgages are getting easier to come by but it’s important to take your time before and make the best decision for you. Knowing your options and doing your research is a huge part of that decision. When the time is right to get back into a home, let us help you choose the right one for you. We’re experienced in every part of the home buying process. Contact us today to explore the right options for you and your family.

Leave a Reply