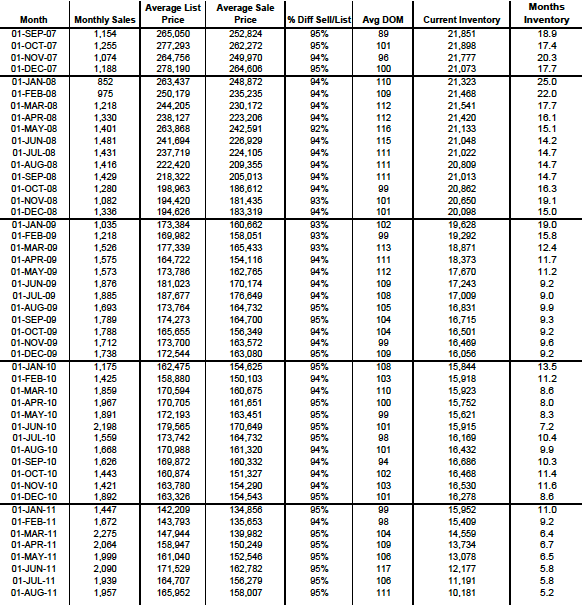

It occurred to me that here it is, late September and we never talked about August’s stats – so here it is folks! Things are looking better. They say in our business that when you hit 6 months of inventory, you are at a balanced market. Lower than that, you are teetering into a Seller’s Market. That’s where we are at, with 5.2 months of inventory in August. The chart below shows a 4 year history in Tampa Bay and is very interesting.

Look back to January 2008. We had 25 months of inventory and now we are down to 5.2! It may sound crazy, given the media spin that is out there, but I’m finding it to be true that we are becoming a balanced, or even a Seller’s, market. Listings are becoming harder and harder to come by. I have buyers who’ve been searching for a home but can’t find the right one and are disappointed because they thought there was so much out there to choose from. The best properties are going in a matter of days. I have one buyer who’s extremely frustrated right now because every time she finds something she likes and calls me to inquire about it, I have to tell her, sorry, that one is already under contract and pending.

The large number of homes for sale that are short sales and foreclosures are keeping prices low, and for that reason investors have gotten back in the game and are buying them up left and right, keeping inventory low too. Many buyers have said to me, do you think we’ve hit bottom? I think we are bouncing the bottom. Around January of this year, prices took a dip into the $130K’s for the average sale price but now we are back up in the $150K’s where we were this time last September. With interest rates flirting with 4%, I don’t think prices will stay this low for long and will likely start to climb as more people realize its smarter to buy right now than to rent with these conditions. Want more real estate stats for our area by price range, number of bedrooms and more? Click here.

Even some of the media outlets like MSNBC are now saying that “new data released on Wednesday from Realtor.com show that median list prices for single family homes, condominiums, townhouses and co-ops have surged within the last year in Florida, one of the states hit earliest and hardest by the housing market crash.”

Don’t wait until everything is gone and supply and demand cause prices to start to climb drastically. If you’ve been thinking about upgrading, downgrading or investing in real estate, now is the time.

Leave a Reply