Q: I need to sell my home and I’m considering selling For Sale By Owner instead of hiring a Realtor to save myself some money. Couldn’t I just use a Tampa flat fee MLS service to get exposure for my home? That way I can pay 3% to buyer’s agents instead of a full 6%.

A: Sure you could. There are several Tampa Bay MLS Flat Fee services in the area to choose from. Most charge anywhere from $599 to $799 to list your home on the My Florida Regional MLS system. Then they’ll charge you additional fees for extras like a lockbox ($100), a professional sign ($75), a featured listing on Realtor.com ($70+ per month), listings on other real estate websites ($150+), contract negotiations and coaching ($300+), etc. Additional 6 Month Listing Term ($100).

Already you are talking about $1594 upfront for services that a Realtor can provide – included. Services which may not get your home sold on their own. When you list with a Realtor you don’t pay unless the house sells. That’s right – I work for FREE until your house sells. Think about it. I spend my own money to market your home and I take the chance that it may not sell. Why would I do that unless I was confident in my abilities to get your home sold?

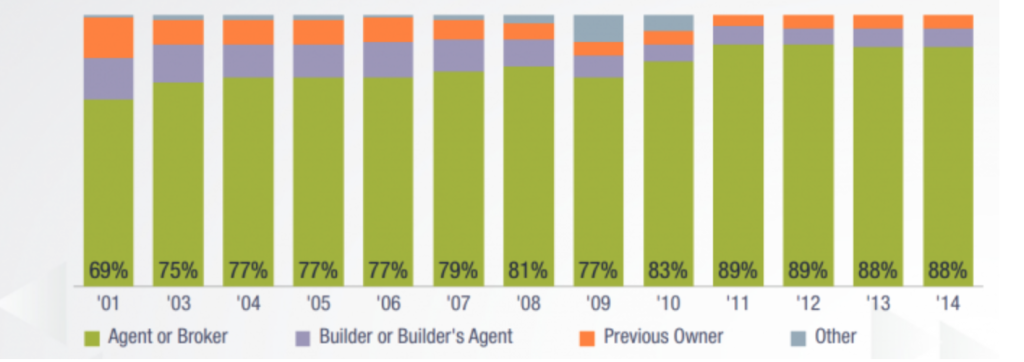

Methods of Home Purchase

For most sellers, when they want to sell by owner, it is because they are trying to save at least the 3% listing agent commission. So let me ask you this – are you aware that most buyers are aware that you are trying to save the commission too?

Here’s what I want you to keep in mind. Most buyers are going to work with a real estate agent. It is free, they get all the knowledge of working with an agent, they go in our car, use our gas, even get taken out to lunch – and when they close, we even get them a nice Target or Home Depot gift card right?

So the only reason a buyer is going to come to you directly as a FSBO is to save money, right?

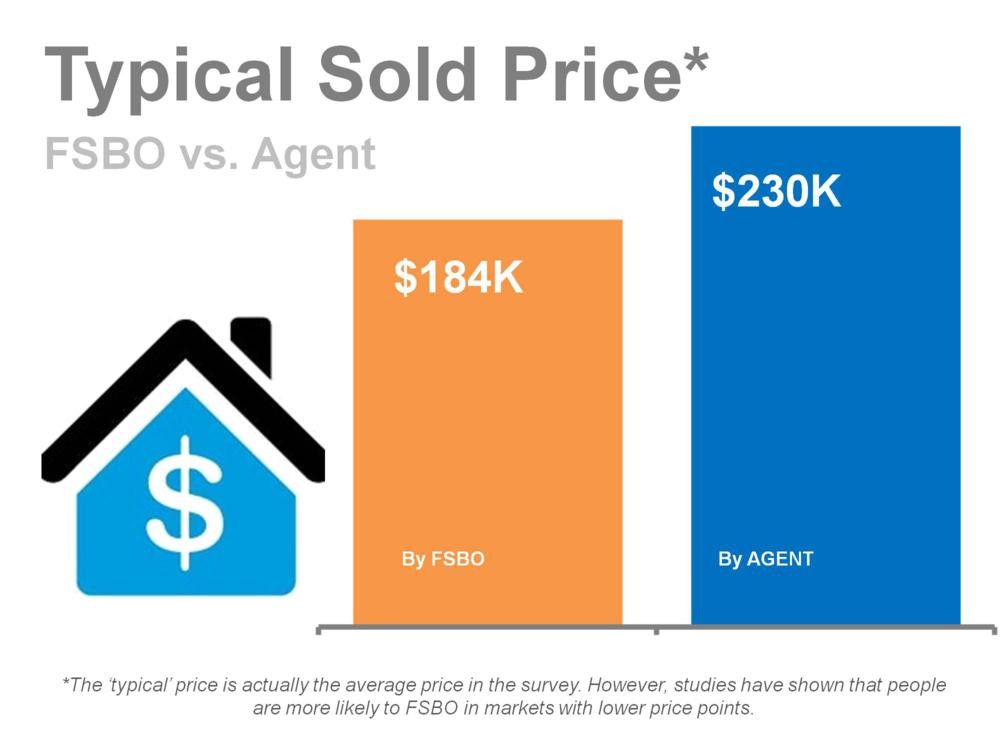

They are fully aware already that you are saving money by not using a Realtor, so right off the top, they are typically going to come in at least 3% off your asking price. Probably more – many FSBO’s get low ball offers because buyers look at it as a way get a bigger discount on a do-it-yourself-er than someone who has professional representation.

It’s like buying a Rolex watch. Would you expect to pay closer to retail for a Rolex at a jewelry store or at a garage sale? A jewelry store would bring a higher price, right? People see homes the same way. FSBO’s generally do not get jewelry store prices.

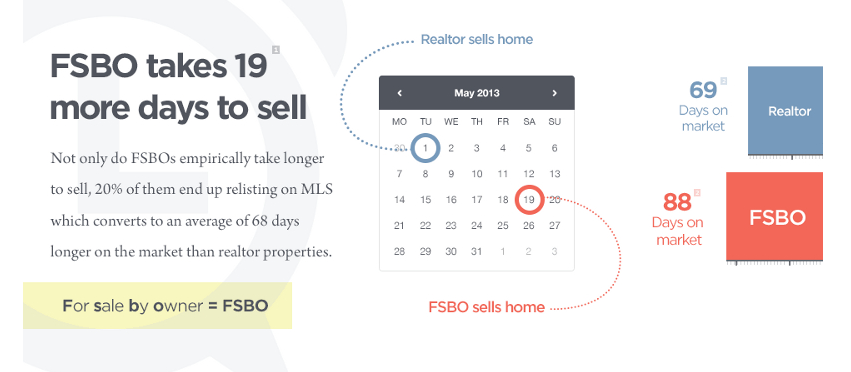

Not to mention – and I hate to bring this up – but most Realtors can tell in the MLS which listings are flat fee services and simply refuse to show those listings. Why, if I’m paying 3% you may ask? Several reasons. Did you know the average Realtor sells only 4 homes a year? Yep – many of them work other jobs or do it part-time. If you only sold 4 homes a year, would you take a chance as a Realtor on a listing you know is a For Sale By Owner flat fee listing? The buyer’s agent knows he or she is going to have to work both sides of the transaction and only get paid for half the work when working with a FSBO. It’s sad but true.

Secondly, most Sellers are not prepared with the knowledge of what it takes to get a home sold and end up wanting representation too (and not wanting to pay for it) and its not fair for a Realtor to be forced to handle both sides, when he or she is a fiduciary for the Buyer. Many Realtors simply don’t want to deal with this, so they show other homes that are listed with Realtors.

As a Seller, your home may be your biggest financial investment – do you really want to be unrepresented in dealing with such a complex transaction? Are you aware of all of Florida’s Housing laws and real estate forms? Is it worth saving 3% if you put yourself at risk of liability because you didn’t disclose something you should have, or ended up leaving money on the table because you could have sold for higher? Just things to think about.

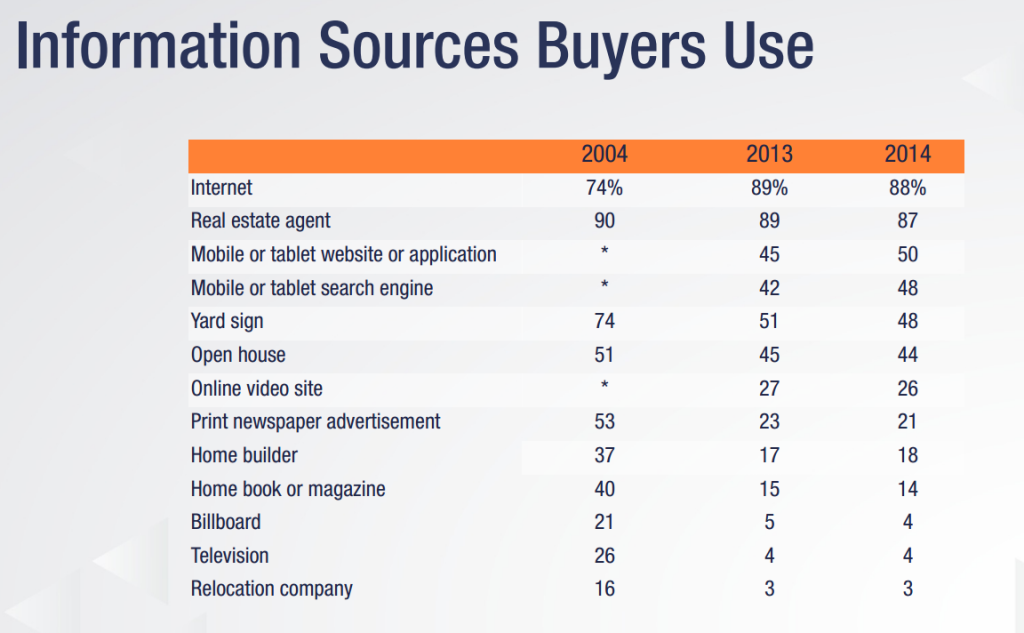

As a St. Petersburg and Tampa Realtor, I eat sleep and breathe real estate. I negotiate the best pricing for my client’s listings, and I fight for my Seller’s when an agent brings us a low ball offer. I expose the property to local, national and international buyers, with hopes of driving competing offers and creating a bidding war! Many people think that when they list with a Realtor, all that Realtor does is put a sign up in the yard, put a lockbox on the house, and put the property in MLS – so why not go it alone? It simply isn’t true (of most Realtors!)

I’m not here to tell you that as a FSBO you couldn’t possibly sell your home yourself. But do you know what it takes to get it closed?

Recently I worked with a FSBO Seller who’s home I’d previewed for a buyer. She’d gone under contract on the home to a lovely military couple who were buying with a VA loan. “Great!”, she thought, “I’ve done it!” However when it came time for the appraisal, the buyer’s lender sent an appraiser from north Tampa to value a St. Petersburg townhouse, and the appraiser used comps that were not even similar to the seller’s townhouse. The result was the appraisal came in way too low and the deal fell apart.

She called me frustrated, about to give up on selling her home. This is where professional representation comes in. If I’d found out the bank were sending us an out of town appraiser, I would’ve refused and told them to re-order it through a more local appraiser. Then if it came in low again, I’d fight the appraisal. I always meet appraisers with my own comps to try to help in any way I can.

Her townhouse is now under contract with me as the listing agent and a new set of buyers, and our appraisal came in at our value.

Here’s a list of 101 things your Realtor should be doing to get your home to the closing table. There are more not included here – things like “Meet A/C guy at house to supervise repair work” – I did that at 7am Monday for one of my listings! Or how about “Show listing at 7pm on Friday night even though buyer was an hour late“? Realtors earn their commissions – I did that last week too!

Typical Pre-Listing Activities

- 1. Research Current Properties

- 2. Research Sales Activity from MLS and public records databases

- 3. Provide Average Days on Market Assessment

- 4. Review Property Tax Roll

- 5. Prepare a Comparable Market Analysis (CMA)

- 6. Verify Ownership and Deed Type

- 7. Verify County Public Property Records

- 8. Perform Curb Appeal Assessment

- 9. Provide Public School Value

- 10. Provide a Listing Presentation

- 11. Analyze Current Market Conditions

- 12. Present Credentials

- 13. Deliver CMA Results

- 14. Discuss Planning and Strategy

- 15. Explain Listing Contract, Disclosures & Addendum

- 16. Screen Calls from Buyers or Agents

- 17. Explain Homeowner Warranty

Selling the Property Activities

- 18. Review Title Details

- 19. Order Plat Map

- 20. Create Showing Instructions

- 21. Obtain Mortgage Loan Information

- 22. Review Homeowner Association Fees and Bylaws

- 23. Submit Homeowner Warranty Application

- 24. Add Homeowner Warranty in MLS

- 25. Review Electricity Details

- 26. Arrange Inspections for City Sewer/Septic Tank Systems

- 27. Collect Natural Gas Information

- 28. Provide Security System Status

- 29. Determine Termite Bond Status

- 30. Analyze Lead-based Paint Status

- 31. Distribute Disclosure Packages

- 32. Prepare Property Amenities

- 33. Detail Inclusions & Conveyances with Sale

- 34. Compile Repairs Needed List

- 35. Send Seller Vacancy Checklist

- 36. Install Lockbox

- 37. Make Copies of Leases for Rental Units (if applicable)

- 38. Verify Rents, Utilities, Water, and Deposits for Rentals

- 39. Inform Tenants of Listing for Rentals

- 40. Install Yard Sign

- 41. Perform Interior Assessment

- 42. Perform Exterior Assessment

Advertising and Marketing a Listing

- 43. Enter a Profile Sheet into the MLS Listing Database

- 44. Provide Copies of MLS Agreement

- 45. Take Additional Photos for MLS and Marketing

- 46. Create and Advertise Property Listing

- 47. Coordinate Showing Times

- 48. Create and Mail Flyers

- 49. Compare MLS Listings

- 50. Develop Marketing Brochure

- 51. Notify the Network Referral Program

- 52. Create Special Feature Cards

- 53. Analyze Feedback Emails

Handling Offers and Contracts

- 54. Receive Offer(s) to Purchase

- 55. Evaluate Net Sheet

- 56. Counsel and Mediate Offer(s)

- 57. Deliver Seller’s Disclosure

- 58. Obtain Pre-qualification Letter

- 59. Negotiate Offers on the Seller’s Behalf

- 60. Mediate Counteroffers or Amendments

- 61. Fax/Scan Contract Copies

- 62. Deliver “Offer to Purchase” Copies

- 63. Assist with Escrow Account

- 64. Distribute Under-Contract Showing Restrictions

- 65. Update MLS to “Sale Pending”

- 66. Review Credit Report

- 67. Deliver Unrecorded Property Information

- 68. Order Well Flow Test Reports (if applicable)

- 69. Order Termite Inspection (if applicable)

- 70. Order Mold Inspection (if applicable)

- 71. Confirm Deposit and Buyer’s Employment

- 72. Follow Up with Loan Processing

- 73. Communicate with Lender

- 74. Confirm Approval of Loan

- 75. Remove Loan Contingency

Home Inspection and Home Appraisal Activities

- 76. Coordinate Buyer’s Home Inspection

- 77. Review Home Inspector’s Report

- 78. Interpret Loan Limits

- 79. Verify Home Inspection Clauses

- 80. Contractor Preparation

- 81. Confirm Repair Completion

- 82. Attend Appraiser Appointment

- 83. Provide Appraiser Information and Remove Contingency

Closing Preparations and Actions

- 84. Ensure Contract is Sealed

- 85. Coordinate Closing Process

- 86. Coordinate Closing Formal Procedure

- 87. Assist with Title Issues

- 88. Perform Final Walk-through

- 89. Verify Tax and Utility Preparations

- 90. Review and Distribute Final Closing Figures

- 91. Request Closing Document Copies

- 92. Confirm Receipt of Title Insurance Commitment

- 93. Make Homeowners Warranty Available

- 94. Review Closing Documents

- 95. Confirm and Assist with Final Deposit

- 96. Coordinate with Next Purchase

- 97. Ensure “No Surprises” Closing

- 98. Final MLS Update

- 99. Follow Up and Resolve Repairs

- 100. Documentation Follow Up

- 101. Hand the keys to the new owner

Leave a Reply