If you’ve been following the papers much lately – you know that there are several big hedge funds buying up a lot of the Tampa Bay short sales and foreclosures in our market. I work for one investor who is not a hedge fund, but buys some properties similar to what the hedge funds are […]

Florida Foreclosure Bill Passes House Committee: Limits Deficiency Judgements

Florida lawmakers passed a measure in attempt to speed up the foreclosure process by making a number of changes to the civil procedures governing the law. Currently, once a foreclosure goes through, a lender has up to 5 years to pursue the homeowner for the windfall between what the homeowner owed on his or her […]

Just Listed: Bank Owned Commercial Land Zoned for Business/Professional Offices

I have just received a brand new listing from Bank of America’s REO foreclosure department. This piece of property has a small existing structure (600 sq. ft.) on it that can easily be torn down. Zoned for business/professional offices. See full details below Great location on busy Gunn Highway! [idx-listing mlsnumber=”U7560805″ showall=”true”]

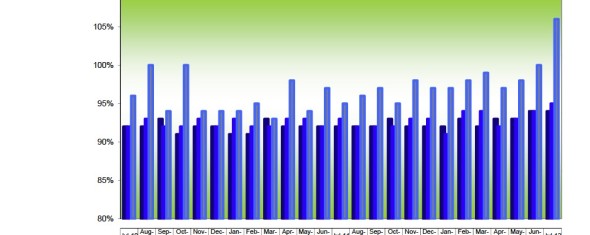

That Foreclosure “Steal” Might Just Cost You More!

Often as Realtors we hear the same thing from buyers – everyone, understandably, wants a deal. Everyone, also understandably, assumes the best deals in the market MUST be on foreclosures. But that’s not always the case. Today’s graph, courtesy of the Pinellas Realtor Organization, illustrates my point. This chart shows what we call the List […]

Before and After Makeover: My Client’s Foreclosure Condo Purchase

Just wanted to post the before and after that my client recently sent me via his iPhone camera of the condo we recently closed on. The condo was previously a foreclosure and had a very 80’s dated look. My client ripped everything out and re-designed it himself and renovated the entire 1200 square foot […]

$25 Billion Mortgage Settlement: What It Means To You

After many months of negotiation, 49 state attorneys general and the federal government have reached agreement on a historic joint state-federal settlement with the country’s five largest loan servicers: Ally/GMAC, Bank of America,Citi, JPMorgan Chase, Wells Fargo . The settlement will provide as much as $25 billion in relief to distressed borrowers and direct payments […]