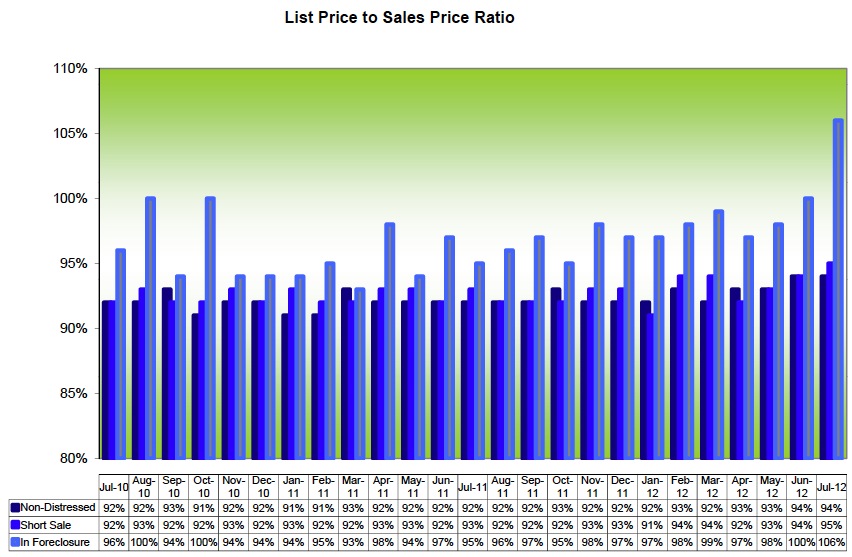

Often as Realtors we hear the same thing from buyers – everyone, understandably, wants a deal. Everyone, also understandably, assumes the best deals in the market MUST be on foreclosures. But that’s not always the case. Today’s graph, courtesy of the Pinellas Realtor Organization, illustrates my point.

This chart shows what we call the List to Sales Price Ratio. This is something to consider when looking at properties for purchase. Let’s say you are considering a 2 bedroom condo on the beach. Perhaps a non-distressed owner is selling their 2 bedroom condo for $200,000. Since banks tend to slightly underprice their foreclosures to create a bit of hype and a bidding war, perhaps a bank owned (REO) foreclosure 2 bedroom condo listing pops up in that same building for $195,000.

Let’s consider how the list-to-sale price ratios would affect these two condos. At first glance – the foreclosure looks to be the best deal, right? Wrong. Since the list-to-sale ratio is averaging 106% on foreclosures, that condo could sell for $206,700 – over the asking price. At a 94% average list-to-sale ratio, that non-distressed condo could sell for approximately $188,000. Now which is a better deal?

Obviously other factors influence what a property ultimately sells for, including how far overpriced it was to begin with (if at all), what improvements it has had, etc. But when seeking a smart investment, it’s wise not to discount non-distressed properties. Hire a Realtor who will do the research for you and find you the best property for your money – it may not be that foreclosure that everyone and his brother is bidding up!

Leave a Reply